Securing growth in the floral industry is as complex and delicate as tending to an exotic bloom. It requires not just horticultural expertise but a steady stream of capital to nurture your business's potential.

That’s where the SBA 7(a) loan comes in, a lifeline offered by the Small Business Administration that promises to be a bedrock for your aspirations. In this article, we will unpack how this financial tool can be the nutrient-rich soil that elevates your floral enterprise from surviving to thriving.

Understanding SBA 7(a) Loans

Understanding SBA 7(a) Loans is akin to knowing the essentials of sunlight for your plants. These loans, backed by the U.S. Small Business Administration, assure lenders that up to 85% of the loan will be covered if you can't pay back.

For smaller loans under $150,000, this guarantee climbs even higher. This safety net makes banks more willing to lend you money, so you can scale up your floral shop, buy more inventory, or invest in marketing—essentially watering the seeds of your business's future growth.

Who’s Eligible for Funding?

Stepping into the world of SBA 7(a) loans means first measuring if your floral business fits the frame. The SBA has set up eligibility markers, such as operating within U.S. borders, showing a genuine need for the loan, and turning to other financial options before asking the government.

Your business should also stay within specific size standards, generally including most independent flower shops. If your petals align with these points—you're on track to cultivate growth with an SBA 7(a) loan by your side.

Laying the Financial Groundwork

Before you start growing your floral business through an SBA 7(a) loan, it’s crucial to lay out your shop's financial landscape. You'll need a strong business plan showing where your floral business is heading and how the loan will help it get there.

Pack this plan with past and current financials plus future cash flow projections to show lenders you know your numbers inside and out. Equally important is a detailed strategy on how you’ll use the funds—be it expanding your storefront or boosting your bouquet delivery service—making sure each dollar has its place in nurturing growth.

The Application Process

When applying for an SBA 7(a) loan, precision is your ally—much like pruning your prize roses. Begin by picking a lender that's approved to work with the SBA; think of local banks or credit unions, which might be more nimble in handling these specific loans.

With a lender chosen, it's time to compile your documents: financials, tax returns, business licenses, and lease agreements if you have them. Having this paperwork ready is like having shears sharp—you’ll cut right through the process. Remember, patience and attention to detail during application can lead to flourishing growth ahead.

Navigating Debt Service Coverage Ratio (DSCR)

The Debt Service Coverage Ratio (DSCR) is a term as critical to your loan application as watering is to your floral displays. It's a figure that lenders use to gauge if your business can comfortably pay back the loan. Often, you calculate it by dividing your net operating income by your total yearly loan payments.

If you're envisioning growth without overextending, aim for a DSCR number well above 1—preferably around 1.25 or more. Like ensuring the right pH level for your soil, maintaining a healthy DSCR means creating an environment where financial growth can thrive.

Navigating Interest Rates and Loan Terms

Securing an SBA 7(a) loan is as much about the interest rates and terms as the soil type matters to your flower bed's vitality. The interest rates for these loans are typically competitive, thanks to a cap set by the SBA, and they're negotiable between you and your lender.

Loan terms with the SBA 7(a) program are also designed for business sustainability, offering up to seven years for working capital or as much as 25 years if you're purchasing real estate. Steady repayment terms mean your business can grow without being choked by immediate financial pressures—think of it as providing your plants enough space to spread out their roots. Additionally, for small business owners looking to manage finances, tools like a debt consolidation loan calculator can help track and optimize repayments.

Achieving Growth Post-Loan Approval

Once the SBA 7(a) loan graces your account, think of it as a newly installed irrigation system—you must use it wisely to ensure every area of your garden flourishes. Allocate the funds exactly as you've outlined in your business plan. This could mean investing in a robust online ordering system or recruiting additional staff for peak seasons.

Moreover, keep a keen eye on managing cash flow. The influx of funds should not tempt you into lavish spending. Keep track like a meticulous groundskeeper—note every penny spent and make sure it's nurturing your business's expansion. Remember, wise investments today can lead to lush rewards tomorrow.

Cultivating Long-Term Prosperity

An SBA 7(a) loan's benefits don't just wither after the initial cash boost—it can set up a perennial cycle of growth for your floral business. Establishing credit with an SBA lender now opens up avenues for additional funding later, akin to pruning your plants to encourage new blooms.

Like a well-tended garden that attracts more visitors each season, a strong lending relationship can yield greater financial opportunities and support future expansion. It sets the stage not just for immediate success but for sustainable growth, ensuring your floral business continues to grow and adapt in an ever-changing market landscape.

Sustaining Momentum Through Adaptive Strategies

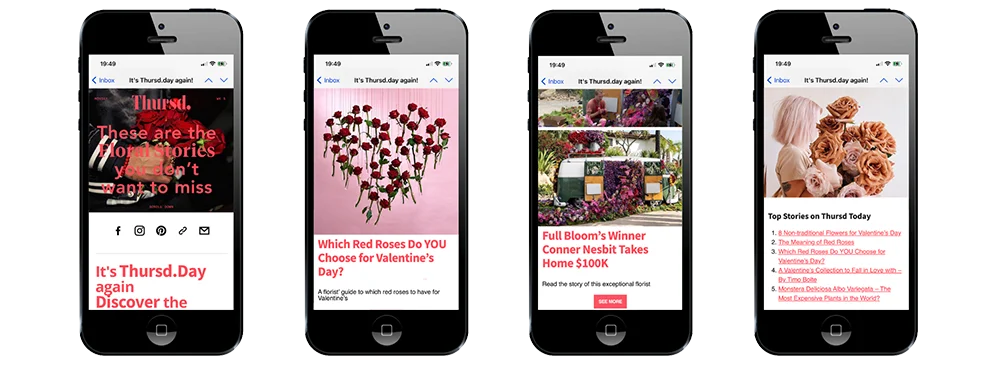

In the cycle of business, as with nature, regular reassessment is key to thriving. With your SBA 7(a) loan nurturing growth, continuously evaluate which strategies are blooming and which may need pruning. Adaptation might mean diversifying your offerings or leveraging social media more effectively to engage customers.

Stay alert to market trends—like a gardener knows when to shelter plants from frost or introduce new species that customers desire. By staying attuned to your business's performance and remaining flexible in your approach, you can maintain robust growth and ensure your floral shop isn't just surviving but flourishing season after season.

The Road to Repayment

Navigating the repayment of your SBA 7(a) loan is as crucial as guiding a vine to its trellis. Consistent loan payments keep the financial structure of your business sturdy and trustworthy. To avoid missteps, consider setting up automated payments or calendar reminders for due dates.

Punctuality in repayment is like regular watering—it's vital for the health of both plants and business relationships. Timely payments contribute positively to your credit history and reinforce a reputation with lenders as a reliable borrower, ready for future growth opportunities. Remember, each successful payment is another step toward cultivating a thriving floral enterprise.

In Conclusion

Rooting your floral business in the solid ground of an SBA 7(a) loan is akin to positioning yourself for sustainable growth. Just as every blossom starts from a seed, so does each strategic financial decision lead to prosperous expansion.

Embrace the journey ahead with confidence; nurture the relationship with your lender, tend to your repayments diligently, and keep adapting to the ever-changing business climate. Your floral enterprise is set to not just bloom but flourish for seasons to come.