“Horticulture M&A is not simply back. It has been recalibrated.”

With that clear observation, Ruud van der Vliet captures the essence of what is currently unfolding in the global green industry. After a period of hesitation in 2023 and 2024, transaction activity is stabilizing. Yet this is not a cyclical rebound driven by sentiment. It reflects a structural shift in how capital evaluates horticulture businesses.

A Decisive Transition

Drawing on the latest insights from Oaklins and BDO, including the January 2026 Oaklins outlook, Ruud frames the current phase as a decisive transition: from volume to quality, from standalone production assets to integrated platform models, and from pure growing capacity toward businesses built around intellectual property, technology, and predictable cash flows. That distinction fundamentally changes valuation logic across the sector.

From Volume to Quality Across the Value Chain

The previous decade often rewarded scale in hectares and production output. Today, investors are far more selective. The emphasis has moved toward resilient earnings, professional management structures, and defensible market positioning. Standalone growing operations without differentiation or cost leadership face more scrutiny, particularly when exposed to energy volatility and labor constraints.

Ruud Van der Vliet emphasizes that capital is no longer chasing volume expansion alone. It is seeking quality metrics: recurring revenues, technological integration, operational predictability, and strategic coherence across the value chain. The recalibration reflects a maturing industry that is increasingly assessed through financial fundamentals rather than growth narratives.

Technology, IP, and Predictable Cash Flows as Core Drivers

Investor demand is increasingly concentrated in four clearly defined areas. Automation, robotics, AI, and data-driven solutions rank high on acquisition shortlists. Persistent labor shortages and rising wage costs make productivity-enhancing technologies structurally attractive. Companies that improve consistency, traceability, and efficiency demonstrate measurable value creation.

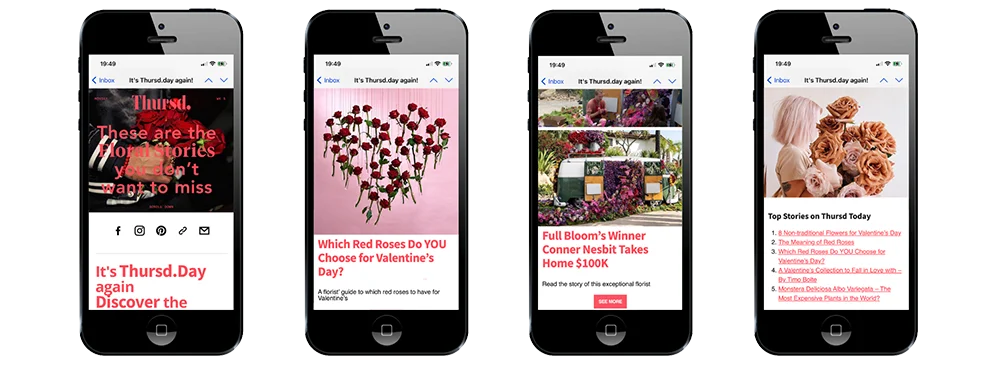

Every stem of chrysanthemum at @beyondchrysant gets checked by experienced eyes and smart systems before it’s approved.

Intellectual property plays a similarly central role. Specialized substrates, biostimulants, coatings, plant-health solutions, and proprietary genetics combine scalability with recurring demand. These businesses typically present lower exposure to energy price volatility and offer more predictable margins. In valuation discussions, predictable cash flows are gaining priority over pure production capacity.

The Rise of Integrated Platform Models

A second structural shift highlighted by Ruud Van der Vliet is the movement away from fragmented standalone assets toward integrated platform models. Propagation businesses and high-tech greenhouse platforms benefit from high entry barriers, biosecurity expertise, and long-term customer relationships. These characteristics make them attractive anchors for buy-and-build strategies.

Integrated one-stop-shop value-chain models further reduce operational and commercial risk. By combining multiple crops, services, technologies, and geographies into a single, structured proposition, these platforms enhance pricing power and resilience. Investors increasingly favor businesses that control more links in the chain and create systemic stability rather than isolated production capacity.

Strategic Momentum for the Well-Positioned

The recalibration of horticulture M&A is therefore not a temporary correction. It represents a structural evolution. Capital is aligning with businesses that solve fundamental challenges in labor, sustainability, professionalization, and supply-chain integration. The direction is clear: from volume to quality, from standalone production to integrated platforms, and from commodity output toward IP, technology, and stable earnings profiles.

For well-positioned companies, this environment creates strategic momentum rather than pressure. Those that combine differentiation, scalable infrastructure, technological capability, and predictable cash flow models are increasingly viewed as foundational assets within a consolidating global green industry. In that sense, horticulture is not simply about returning to past activity levels. It is entering a more disciplined and strategically defined phase of capital allocation.