Colombia's floriculture industry is bracing for substantial operational costs following President Gustavo Petro's decree raising the minimum wage by 23.7%, effective January 1, 2026. The decision, described by industry leaders as the largest wage hike in the country’s recent history, is a departure from traditional economic policymaking and could affect the competitive landscape for the flower industry, one of the country's most important export sectors.

Were There Political Undertones Behind the Wage Decision?

At 23.7%, the new minimum wage adjustment is nearly four times what would have resulted from Colombia's traditional wage-setting formula, which has historically been based on inflation rates and labor productivity changes and has made modest adjustments. This minimum wage is typically set through an annual negotiation process among the private sector, labor unions, and the government.

But this year's process diverged from precedent. With the country’s current inflation hovering near 5% and labor productivity measured at approximately 0.9%, the private sector proposed a 7.2% wage increase, while labor unions requested 16%. Technical criteria would have suggested a much more modest adjustment.

However, when these parties failed to reach consensus by mid-December, the decision fell to President Petro, who exercised his authority to decree the final increase. But his administration will complete its term in August 2026, with national elections planned for the end of the first semester.

Against this electoral backdrop, many view the wage decree as politically motivated rather than economically justified, with limited consideration given to the broader consequences for Colombia's productive sectors. This raises concerns about its sustainability and economic consequences.

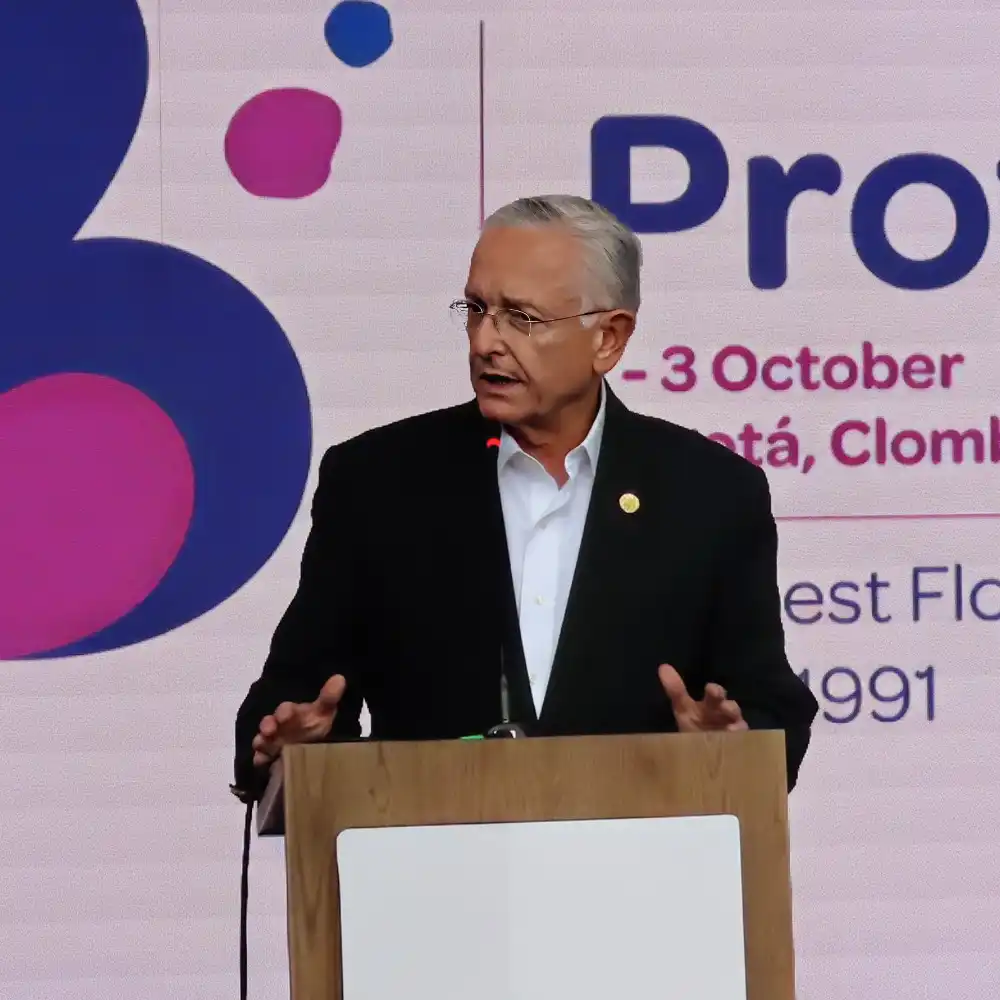

Augusto Solano, President of Asocolflores, the Colombian Association of Flower Exporters, expressed concerns about the lack of technical support for the decision and its potential impact on exporting industries, which are the key engines of the Colombian economy.

In a recent industry webinar, Asocolflores President Augusto Solano provided rare insight into the implications of Colombia’s minimum wage increase for the flower sector. His analysis outlines why the 23.7 percent rise represents a structural cost shift rather than a temporary adjustment, with direct consequences for labor-intensive exports, peak-season planning, and global supply chain alignment. The full breakdown offers essential context for buyers, importers, and industry decision-makers.

“Its [the wage decision’s] impact will be felt across the economy, particularly in exporting industries such as floriculture, which are already facing challenges from currency appreciation in recent months.”

The Floriculture Sector Is Particularly Under Pressure

The floriculture sector faces uniquely acute challenges from this wage policy. Unlike manufacturing or service industries with varied cost structures, flower growers operate under a distinctive economic model. The industry is highly labor-intensive, with personnel costs accounting for 50%-60% of total production expenses. This indicates that a 23.7% increase in the minimum wage will substantially raise the industry's largest cost component. This is an increase that cannot be easily absorbed or offset.

The Colombian floriculture industry has built its international reputation on delivering premium-quality flowers while maintaining rigorous standards in sustainability and social responsibility. These obligations require significant investment in training, working conditions, and compliance systems, all of which increase labor-related costs beyond base wages.

This decreed minimum wage increase comes at a particularly difficult moment for Colombian flower exporters. In recent months, the industry has been grappling with currency appreciation, which affects the competitiveness of Colombian products in international markets. When the Colombian peso strengthens against major currencies like the US dollar and Euro, the revenues that flower growers earn from exports mean fewer pesos domestically, which squeezes profit margins even before considering increased labor costs.

This pressure, from currency headwinds and higher wage requirements, creates a perfect storm for an industry that operates in highly competitive global markets. Colombian flowers compete directly with those from Ecuador, Kenya, Ethiopia, and other countries where labor cost structures may be more favorable. What will be the impact in this case?

What Does It Mean in the Global Context?

As a leading global flower exporter, second only to the Netherlands, Colombia has built its position over decades through investment in infrastructure, innovation, and human capital. Colombian flowers, particularly roses, carnations, and Chrysanthemums, are prized in markets across North America, Europe, and Asia for their quality, variety, and year-round availability.

The industry employs hundreds of thousands, many in rural areas where alternative employment opportunities may be limited. Flower farms have historically been significant contributors to economic development in regions surrounding Bogotá, Medellín, and others, providing wages, training, healthcare benefits, and community support programs.

What Is the Industry’s Response?

Despite the severity of these challenges, Colombian floriculture leaders emphasize the sector's proven resilience. The industry has weathered numerous crunches over the years and continues to adapt and persist. This time is not much different. Asocolflores has signaled that flower growers will need to pursue other strategies to navigate this new reality.

The sector's response will likely involve several strategies, such as improving operational efficiency, enhancing productivity through better agronomic practices, renegotiating supplier contracts, and working with government entities to develop interim support mechanisms. But the emphasis remains on maintaining the quality standards and reliability that Colombian flowers are known for, without affecting supply and delivery, even as cost pressures intensify.

For international buyers and Colombian flower growers’ partners, the impasse underscores the importance of long-term relationships built on a shared understanding and commitment to sustainability. As the industry adapts to this new cost structure, collaboration across the supply chain will be essential to ensuring that Colombian flowers continue to reliably reach global markets while supporting the livelihoods of the workers who grow and tend them.

Featured image by @floresdeleste. Header image by @fillcoflowers.