Buying your first home is one of the biggest financial steps you’ll ever take. It’s exciting to imagine decorating, entertaining, and putting down roots. But the process also comes with challenges. Preparing before you jump in can save you money, time, and stress.

Here are practical tips to give you a strong start.

Know Your Financial Readiness

Before house hunting, review your finances. Check your credit score since lenders use it to determine interest rates and loan options. A higher score can save you thousands over the life of a mortgage.

Start with the down payment, which usually ranges from 3% to 20% depending on the loan type. Many first-time buyers also forget about closing costs, which often run from 2% to 5% of the purchase price.

Beyond those upfront expenses, think about the ongoing costs of ownership. Set a budget that covers mortgage payments, property taxes, utilities, and maintenance. Don’t forget homeowner's insurance, which protects your investment.

Being realistic about your financial readiness helps you avoid stretching yourself too thin, so your first home feels like an accomplishment, not a burden.

Build an Emergency Fund First

Buying a house is only the beginning. Unexpected expenses almost always pop up. A roof might leak, an appliance could break, or you might need repairs right after moving in. Without savings, these surprises can push you into debt.

That’s why you need an emergency fund in place before starting your home search. Aim for at least three to six months of living expenses. Having that cushion means you won’t panic if something goes wrong. Instead, you’ll have peace of mind knowing you can handle it.

Get Pre-Approved, Not Just Pre-Qualified

Pre-qualification gives you a rough idea of what you can borrow. Pre-approval goes further. A lender reviews your financial records and confirms how much they’ll lend. Sellers take pre-approval seriously because it shows you’re ready to buy.

Tips for first time home buyers from trusted resources backed by real estate experts can guide you through the pre-approval process, from organizing paperwork to understanding what lenders look for. They make the process less intimidating and give you confidence when making offers.

Pre-approval also helps you compare home loan types. A fixed-rate loan gives steady payments, while an adjustable-rate loan may start lower but change later. Knowing the difference prepares you to choose the best option for your situation.

Research the Neighborhood

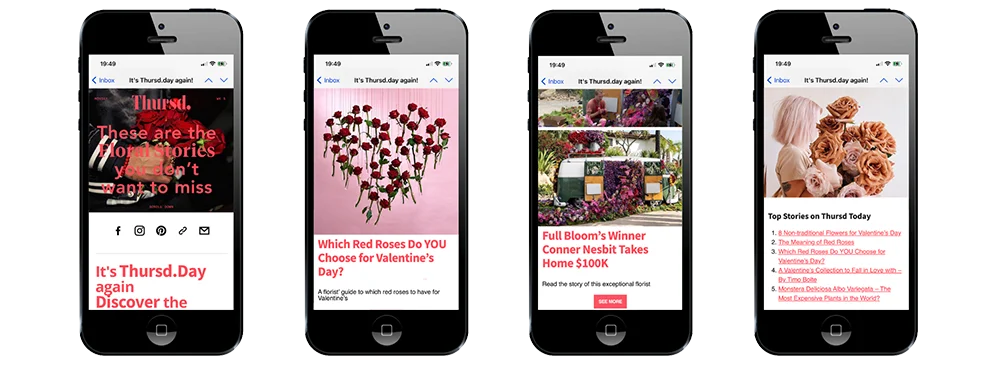

It’s easy to fall in love with a kitchen or backyard, but the neighborhood shapes your daily life. Visit the area at different times of day. Check the commute, noise levels, and what shops, parks, or gardens are nearby.

If you enjoy spending time outdoors, look for homes with space to grow plants or care for flowers. Even a small garden can add comfort and value to your daily routine.

If you have kids, research the schools. Even if you don’t, school ratings can affect property value. Safety is another factor. Talk to neighbors or use local resources to understand crime rates. Doing your due diligence here can make the difference between a great purchase and regret.

You can also build a simple property search strategy by listing your must-haves and dealbreakers. That way, you’ll focus on homes that truly fit your lifestyle and budget.

Work With a Knowledgeable Real Estate Agent

You might think you can handle the process on your own since there are countless listings online. But a good real estate agent offers moSre than access to homes. They know the market, can spot issues you might miss, and help you negotiate.

The right agent also understands local programs, financing options, and the challenges of purchasing a first home. That support makes it easier to find someone who fits your needs and helps you move forward with confidence.

When choosing an agent, look for experience with first-time buyers. Ask for references, check reviews, and interview more than one person. Since you’ll work closely together, make sure their style and communication feel right to you.

Avoid Big Financial Changes Before Closing

Once you’re in the buying process, stability is key. Lenders reassess your finances before final approval. Taking on debt, opening a credit card, or changing jobs could raise red flags. Even a small change can jeopardize your loan.

It might be tempting to buy furniture or a new car before moving in. Resist that urge until after closing. Keeping your financial picture consistent ensures a smoother path to getting the keys.

Don’t Skip the Home Inspection

Some buyers consider skipping the inspection to speed up the process, especially in a competitive market. That’s risky. A professional home inspector can uncover hidden problems like faulty wiring, water damage, or foundation issues.

If problems come up, you have options. You can negotiate for repairs, request a price reduction, or even walk away if it’s too costly. An inspection gives you leverage and helps you avoid buying a money pit.

Think Long-Term

Your first home doesn’t have to be your forever home, but it should fit your needs for the next several years. Consider how your lifestyle might change. Will you work remotely more often? Do you plan to start a family?

Also, think about resale potential. A home in a good location with solid features will be easier to sell when you’re ready to upgrade. Try not to get swayed by trendy finishes that may lose appeal quickly. Focus instead on the layout, structure, and overall potential.

First Home is a Milestone

Buying your first home is a milestone, but it’s also a major responsibility. Preparing ahead makes the process smoother and less overwhelming. Check your finances, secure pre-approval, research neighborhoods, and lean on professionals who can guide you.

Most importantly, don’t rush. Taking the time to plan ensures your first home is both a smart investment and a place you’ll enjoy living in. With the right preparation, you’ll feel confident about every step of the journey.