In an industry founded on tradition yet driven by innovation, a new class of companies is reshaping the way flowers move: from genetics to bouquets.

Across the global floriculture landscape, one trend is becoming impossible to ignore: vertical integration at scale. These are the quiet giants. The ones who rarely announce their moves, yet whose strategies ripple across continents, influencing supply chains, pricing structures, and the very language of logistics.

How the Quiet Giants Consolidate Power Through Strategic M&A

The upper tier of global floriculture is no longer scaling through production alone. It is scaling through ownership of the chain. Dutch Flower Group illustrates this shift clearly. The acquisition of Airflo in 2020 secured critical cold-chain and freight corridors from East Africa into Europe, reducing exposure to volatile logistics markets and tightening logistical certainty.

The integration of Super-Flora expanded DFG’s retail-ready bouquet capabilities across major European supermarkets, reinforcing its position within retailer planning cycles. In 2023, the group acquired Nini Herburg Roses, adding more than 200 million stems of annual Kenyan and Ethiopian rose supply to its upstream production base. Strategic expansion with Van Dijk Flora further strengthened DFG’s ability to service high-volume retail programs with predictable, consolidated sourcing.

The Elite Group Is Executing a Similar Blueprint

But with a distinctly global tempo. The merger with Royal Flowers Group in 2023 created a stronger, more diversified platform with deeper genetics and broader farm structures. The 2024 acquisition of The USA Bouquet Company anchored Elite at the retail level across North America, expanding its role in design, fulfillment, and mass-market distribution.

Over recent years, the group has consolidated multiple Benchmark-linked Ecuadorian farms and absorbed several Miami importers to streamline its logistics and sales engine. Most notably, Elite has now entered the African continent through production partnerships and stakes in East African farms, building diversification in climate zones and creating year-round stability in core crops, an expansion confirmed through industry announcements and regional trade sources. These moves signal a structural shift: integration is no longer an advantage. It is the operating model shaping the next generation of industry leaders.

The Model Is More Than Just Owning the Product

This new breed of floriculture titan doesn’t just sell flowers. They:

- Breed new genetics in-house.

- Grow on a scale that spans countries and climates.

- Design bouquets tailored for retail efficiency and consumer appeal.

- Distribute globally with their own or partner logistics.

- And most intriguingly — stay largely silent while doing it.

In an age of transparency, data, and storytelling, this silence is strategic. These companies don’t need press releases because their influence is felt in the market.

And yet, they are present. Not online, but in the rooms that matter: the trade shows, conventions, and deal tables where the future of the industry is being quietly written.

Why Vertical Integration Now?

The logic is compelling:

- Rising fuel and logistics costs make control over shipping and consolidation essential.

- Retailers demand pre-packed, ready-to-sell solutions, not just stems.

- E-commerce growth and next-day delivery pressures reward tight, internalized operations.

- Branding is no longer a luxury; it’s a necessity.

But there’s a flipside: vertical integration can feel impenetrable. If you’re not inside the system, you might be left on the outside looking in.

.jpg)

Is this the blueprint for the future of floriculture?

The growing preference for vertically integrated models is closely aligned with broader capital trends in floriculture. As explored in our analysis of private equity in floriculture, investors are increasingly prioritizing scalable platforms, predictable cash flows, and defensible market positioning. Vertical integration is not simply an operational choice; it has become a financial strategy that enhances valuation logic and long-term resilience across the supply chain.

The Challenge for the Flower Industry

As this model gains traction, the rest of the industry — from independent growers to regional distributors — must ask:

How do we stay relevant in a vertically integrated world?

The answer may lie in alignment, not resistance.

- Collaborative platforms that connect rather than compete.

- Media and communication channels that amplify stories across the chain.

- Technology that unlocks data, transparency, and ease of transactions.

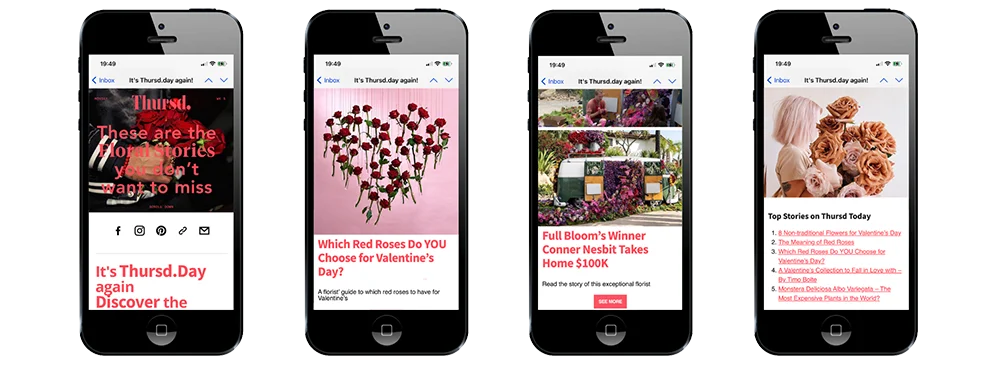

Thursd’s Vision is a Bridge, Not a Barrier

At Thursd, we see what’s happening, and we’re building the infrastructure to connect, not fragment.

- With our editorial reach, we spotlight the brands and designers shaping floral trends.

- Through myThursd Meetup Spot, we’ve built a promotional and transactional platform that brings growers, designers, and buyers together.

- Our roadmap is clear: build the Booking.com of floriculture, with space for everyone willing to evolve.

We’re not here to own farms or bouquets. We’re here to tell the story. To build the connections. To be the infrastructure of visibility and trust that even the most vertically integrated players can leverage.

Because in the end, even the quiet giants need a place to be seen, but only when they’re ready.